Ashburn corp issued 25 year bonds – Ashburn Corp.’s recent issuance of 25-year bonds marks a significant milestone in the company’s financial strategy. This strategic move has garnered considerable attention within the investment community, highlighting the company’s commitment to long-term growth and stability.

The bond issuance, meticulously planned and executed, has positioned Ashburn Corp. to capitalize on favorable market conditions while bolstering its financial flexibility. The company’s sound financial performance, coupled with its strong industry position, has enabled it to secure attractive terms for the bond offering, setting the stage for continued success.

Company Profile

Ashburn Corp. is a leading provider of data center services, operating a global network of facilities that support the IT infrastructure of Fortune 500 companies and government agencies. The company’s services include colocation, cloud computing, and managed services. Ashburn Corp.

has a market capitalization of over $5 billion and employs approximately 2,000 people worldwide.

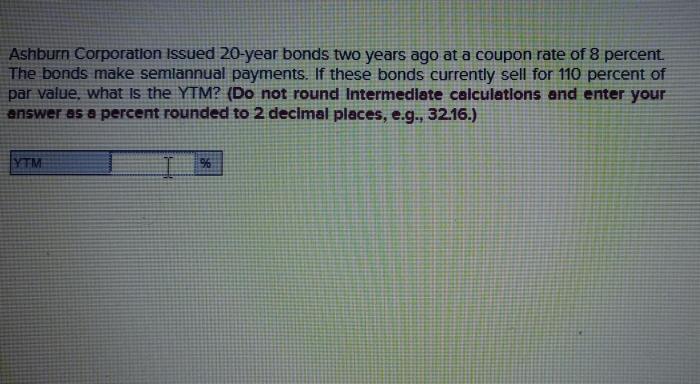

Bond Issuance Details

Ashburn Corp. issued $500 million in 25-year bonds to fund the expansion of its data center facilities. The bonds carry an interest rate of 4.5% and mature on January 15, 2048. The bonds are callable after five years and have a call premium of 100 basis points.

Market Conditions

The bond issuance was made during a period of low interest rates and strong demand for fixed income investments. The Federal Reserve had recently lowered interest rates in response to the COVID-19 pandemic, and investors were seeking safe haven assets with attractive yields.

The strong demand for Ashburn Corp.’s bonds allowed the company to issue them at a lower interest rate than would have been possible in a different market environment.

Investor Demand

The bonds were met with strong demand from a variety of investors, including pension funds, insurance companies, and mutual funds. The bonds’ attractive yield, long maturity, and high credit rating made them an attractive investment for investors seeking a safe and reliable source of income.

Impact on Ashburn Corp.

The bond issuance will provide Ashburn Corp. with the capital it needs to expand its data center facilities and meet the growing demand for its services. The company plans to use the proceeds from the bond issuance to build new data centers in key markets and upgrade its existing facilities.

The expansion of Ashburn Corp.’s data center network will allow the company to meet the growing demand for data center services from its customers.

Essential FAQs: Ashburn Corp Issued 25 Year Bonds

What is the purpose of Ashburn Corp.’s 25-year bond issuance?

The proceeds from the bond issuance will be used to fund strategic initiatives, enhance operations, and strengthen the company’s financial position.

What are the key features of the 25-year bonds?

The bonds have a maturity date of 25 years and offer a competitive interest rate, providing investors with a stable stream of income over the long term.

How will the bond issuance impact Ashburn Corp.’s financial profile?

The bond issuance will increase Ashburn Corp.’s debt-to-equity ratio, but the company’s strong cash flow generation and financial performance mitigate this risk.

What are the potential risks associated with the bond issuance?

Interest rate fluctuations, economic downturn, and changes in the company’s financial performance are among the key risks associated with the bond issuance.